Contents:

You must have heard quite often the opinion that trading with the trend is the most successful. This strategy is based on the idea that the asset price tends to continue the trend movement, and a reversal is less likely. Rarely, trend lines are used as the price movement vector. The Auto Trend Lines Indicator displays only the most actual trend lines.

https://forexaggregator.com/ trendlines of best fit, which provide visual cues about probable trade areas. A trendline is only confirmed if you can get three points of contact because you can always connect any two random points on your charts. As the above chart illustrates, when a downward sloping trendline is present, you should refrain from holding a long position, as the upward movement is unlikely. The angle or slope of trendlines indicates the strength of a trend. They are a useful and relatively simple tool for traders when utilized correctly.

How To Draw A Rising Trend Line In An Up Trend

Those looking to spot and trade the next trend may need to be patient if studying EURUSD in the near future. The binary nature of the possible outcomes makes trendlines relatively easy to trade. In their simplest form, price does or doesn’t bounce/break. The below example of gold shows bearish price action during the time period August to September 2021. The trend lines is a basic analysis tool, so it’s compatible with any indicator and trading system.

Russell 2000 technical analysis – ForexLive

Russell 2000 technical analysis.

Posted: Sun, 12 Feb 2023 08:00:00 GMT [source]

You could set your stop loss just above the nearest swing high. You could set your stop loss just below the nearest swing low. If price heads down to the rising line, that line can act as zone or level of support for price and you can see price hit it and move back up. A falling trend line shows that the market is in a down trend and a break of it can mean that the market is now in changing to an up trend. You have the money management skill, which most people do not.

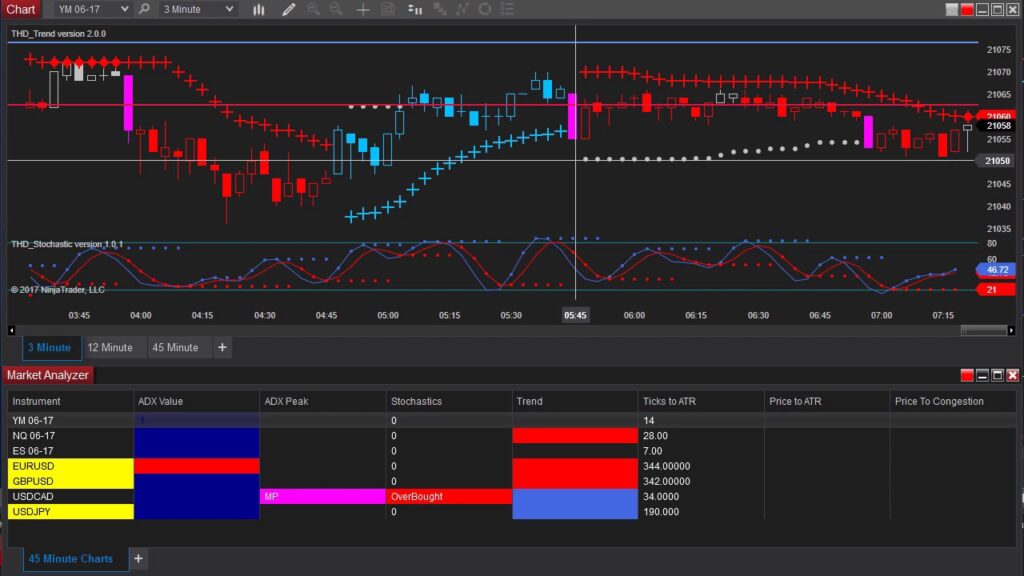

A forex chart graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs. The chart below displays the three-day RSI for the euro/yen cross. Readings above 1.00 indicate that the price is higher today than it was 28 days ago and vice versa. The blue line represents a 28-day moving average of the daily ROC readings.

This https://trading-market.org/ first measures the difference between two exponentially smoothed moving averages. This difference is then smoothed and compared to a moving average of its own. So let’s consider one of the simplest trend-following methods—the moving average crossover.

Top 5 Best Forex Scalping Strategies That Work

https://forexarena.net/rs also use multiple trend lines to draw price channels and various other price patterns like flags, wedges, and so forth. Some traders may specify that they’re trading lines have to be about 40 candlesticks long, 30 candlesticks long, etc. So, a trendline may span several hours, weeks, or months depending on the time frame used and its length.

There is a third type of trendline trading system on top of downtrend and uptrend. This is known as sideways and is a trend analysis method in which a trader is neutral about the direction and usually is looking for market consolidation in currency trading. The truth is, there is no one way to trade the forex markets.

- The result is a moving average channel that reflects a dynamic price equilibrium.

- However, we need to wait for trendline confirmation, and at least several highs or lows need to be connected using our trendline.

- They cut through the noise to show whether there is an underlying bull or bear run.

- But on the other hand, more and more trailing stops are accumulating below this trend line.

- That shows you how to draw trend lines perfectly every time.

These bullish trendlines signal that market prices of an asset in the financial markets are rising and are expected to continue rising as long as the trend is valid. To sum up, the forex chart patterns technical analysis is a crucial part of the Forex price action trading. We had a look at the most common price formations and which ones are our favorites to trade.

Reversal Chart Patterns

It’s recommended to place Stop Loss order under the previous low by a sufficient number of points so that it’s not triggered by a false breakout. As you can see from the picture above, the indicator perfectly identifies true and false breakouts. The solid line is the trend line that the indicator was able to determine.

If you think that trend line is useless, then I want you rethink again. As you see, Flags and Pennants’ technical analysis works exactly the same way. The main difference versus flags is that the price pauses and fluctuates in a horizontal range that decreases before breaking instead of moving within two parallel lines. Each of these six formations has the potential to activate a new impulse in the direction of the previous trend. Identify your strengths and weakness as a trader with cutting-edge behavioural science technology – powered by Chasing Returns.

Case Study – Using Trendlines to Trade Trends in Forex – EURUSD

To draw a trend line in TradingView, as shown below, select “Trend Line” from the drawing panel on the left-hand side. We can also use this strategy to identify a bullish reversal. One thing to note about using trend lines in this way is thatit works best when you have a really clean trend line with three or more touches. Below is an example of a market that broke trend line support and then retested that same trend line as new resistance. At this point in the lesson, you know that a trend line can be used to identify potential buying or selling opportunities. This is a perfect example of the type of buying opportunity a trader would look for using trend line support.

To find a downtrend, you draw a line between three high points. Whatever your approach to the markets, the difference between success and failure will often depend on how well you can time your trends. If you can open positions as they form – then close before they reverse – then you’ll soon see your profit margins grow. We’ve already covered the strategy of trend trading in the Strategies and risk course. But whatever your chosen style, learning how to identify and classify trends as they form can go a long way to trading successfully.

AUD/NZD Daily Price Chart

The first one equals the size of the wedge – marked with the smaller pink arrow. Both should be applied starting from the moment of the breakout. To enter a Double Top trade, you would need to see the price breaking through the level of the bottom that is located between the two tops of the pattern. We will discuss the bullish version of the pattern, the Double Top chart pattern, to approach the figure closely. This time we approach the 5-minute chart of the USD/JPY for January 6, 2017. The image gives an example of a bull Pennant chart pattern.

- If the timeframe that you use for the previous step is daily, then switch over to 4hr or 1hr.

- In the example above we have a trend that turns into a consolidation, and then the trend is resumed again.

- Triangles are formed when the market price starts off volatile and begins to consolidate into a tight range.

- Then, using a few rough filters, it will exclude more than half of the lines found.

- Of course, it is painful to see that you wouldn’t have stopped out if you had drawn your trend line differently.

- But if you are new to Forex markets and need a good foundation, start with checking out the Forex for beginners article.

But before we go into more details you need to know that the trend lines in a channel should be parallel to each other and if they are not they can lead to a false signal. You have to utilize points one and two to draw the trend lines, but there must be proper space between them. Valid trendlines need to connect at least 3 lows for the upper trendline or 3 high for the down trendline. When validating trend breakouts, you can use other indicators. As an additional research assignment, learn about validating breakouts.

Maximizing returns with forex trading: a Canadian investor’s guide – NameCoinNews

Maximizing returns with forex trading: a Canadian investor’s guide.

Posted: Wed, 01 Mar 2023 12:32:57 GMT [source]

Here you can converse about trading ideas, strategies, trading psychology, and nearly everything in between! —- We also have one of the largest forex chatrooms online! —- /r/Forex is the official subreddit of FXGears.com, a trading forum run by professional traders.

Written by: admin

Previous post

labelCasino game todaySeptember 14, 2022

Schools With Hunter Safety, Shooting Sports Could Be Defunded Texas Fish & Game Magazine

The casino’s sweepstakes games stand out for their fabulous graphics and numerous gaming features that make the fun even more thrilling. They are great to play right on the go, just any time you have a spare minute. These are [...]

Similar posts

labelForex Trading todayDecember 6, 2022

Itrader Review: Scam Update

Contents: Itrader Regulatory Protection Limits Trading and Investment Tools Itrader Bonds Trading Itrader Account Opening This broker highlights the need for beginners to understand the ABCs of forex trading. To start, iTrader has an unusually distressing past in the forex industry, and it’s CySEC license was temporarily suspended due to false advertising. Unfortunately, there is [...]

labelForex Trading todaySeptember 15, 2022

Forex Trend Lines

Contents: How To Draw A Rising Trend Line In An Up Trend Top 5 Best Forex Scalping Strategies That Work Reversal Chart Patterns Case Study – Using Trendlines to Trade Trends in Forex – EURUSD You must have heard quite often the opinion that trading with the trend is the most successful. This strategy is [...]

Post comments (0)